問答集

PAT WANG 第一保健

2020年10月27日

INTERVIEW BY JENNIFER HENDERSON

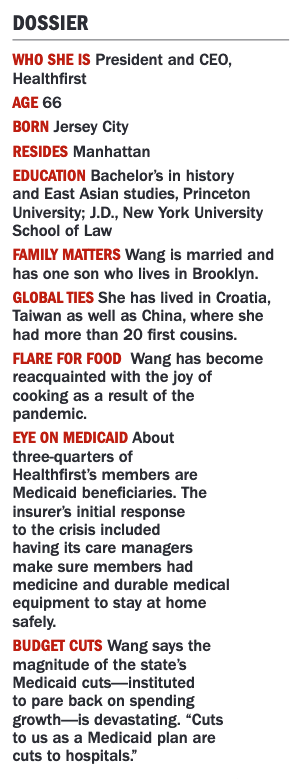

Pat Wang, president and CEO of Healthfirst, a nonprofit insurer formed by a group of health care systems, had been working to advance value-based care long before the pandemic. The concept involves paying hospitals and physi- cians based on their patients' outcomes rather than on the

volume of services they provide. Now, as health care providers face unprecedented financial strain due to the Covid-19 crisis, Wang says such payment arrangements are more critical than ever. Not only do they improve the quality of care for patients-including the 1.5 mil- lion plan members Healthfirst serves throughout the city, Long Island and surrounding areas-but they also generate fiscal benefit for the facilities, practices and health centers that serve them.

How does Healthfirst contribute to value-based care?

What you understand as profit in another health insurance company's balance sheet at Healthfirst is contractually-driven surplus that goes back to the delivery system. Eighty percent of the premiums we get for medical services flows through value-based payment arrangements, which means that providers benefit when there is a surplus in the premium. If less money is spent on fee-for-service claims, the surplus is part of the contractually-obligated payment stream.

What has that meant during the pandemic?

For April through June, we are distributing $250 million in those surpluses [about double that of the same period last year], and we’ve expedited the calculation and reconciliation of those amounts to get them out the door faster because the delivery system really needs it.

Why are value-based payments vital now and in normal times?

In the best of times, we have always been trying to push for this model because it aligns the incentives around trying to keep people healthy and avoiding unnecessary care. The providers are aligned with that goal because they benefit from it if they can reduce avoidable care. Consider Covid-19 to be like a war.

In war times, the model has been a lifesaver because there is this artificial depression of utilization, and that's why the providers have lost so much money-their revenue has dried up. But because we have these risk contracts, the surplus that is there, that's what has gone out the door to them.

What happens when patients again begin seeking services?

We do see utilization coming back, and we have been encouraging our members to get needed care because people have put a lot of stuff off. We have to see whether the bounce back is gigantic or it just brings things back to a steady state. If we go back to a more normal utilization pattern, then the regular incentives of trying to align around good preventive care and avoiding unnecessary care, they just kick in.

How can the city safely bounce back from the pandemic?

Continue doubling down on the public health measures already in place: wearing masks, social distancing and hand sanitation. We know what to do. But I think a singular focus on getting the schools open for full learning should top the list of what we are aiming for. We should measure our success against that goal. As an employer, I can tell you that we will not be able to get fully back to work until the thousands of employees with school-age children can get their kids back into school. It's of course better for all children and particularly critical for poorer children. The city's economic recovery is going to hinge on how quickly and how well we can get that done so that parents can resume their normal lives too. As a longtime resident of the city who has watched us recover from recession, 9/11 and Hurricane Sandy, I believe in the city's ability to bounce back against the odds. But this time is going test all of us, and we should be sober about the need for everyone to contribute to the solution.

What challenges face the broader insurance industry?

Balancing the needs and expectations of consumers who need and deserve good health care coverage, expand- ing access however we can and doing it within an increasingly constrained economic environment. This is especially true with Medicaid, where the state's budget situation is dire at the same time as people's needs

are increasing. Given that Healthfirst has over 1 million Medicaid members, the potential impact of the state's budget is especially concerning. For me, our priority has to be enabling as many people as possible to have full access to high-quality care, and it's going to be a challenge to figure out how to do that in this economic environ- ment. Insurers also need to be mindful of the hurt being experienced by so much of the provider delivery system. The value of our products relies on having strong doctors, hospitals and community resources. Balancing all of this in a financially viable way is going to be a challenge